How to Calculate Payroll Taxes

This article was up to date as of 7/29/2020. For updated information on employment taxes, visit https://www.irs.gov/forms-pubs/about-publication-15-t.

As an employer, you’re required to withhold certain taxes from your employees’ paychecks. You’re also required to remit these taxes to the IRS and state tax agencies on their behalf. These payroll taxes include:

- federal income tax

- Social Security taxes

- Medicare taxes

- state and local payroll taxes

When you’re running payroll, it’s essential that you withhold the correct amount of taxes to avoid steep penalties and protect your employees from fines. If you would like to calculate payroll taxes yourself, keep reading to learn how.

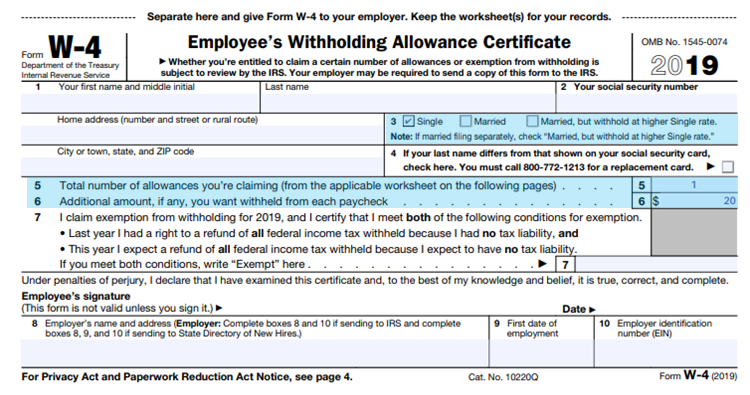

Step 1: Use your employee’s W-4 to determine federal income tax withholding

The IRS gives you two options for calculating federal income tax withholdings: the percentage method and the wage bracket method. While neither option is simple, it’s easier to calculate taxes using the wage bracket method. The IRS has included two worksheets in IRS Publication 15-T to help you calculate federal income tax:

- Worksheet 2 should be used with Forms W-4 from 2020 or later

- Worksheet 3 should be used with Forms W-4 from 2019 or earlier

Note: The wage bracket method covers up to approximately $100,000 in annual wages. If an employee’s wages exceed that amount, use the percentage method.

Example using a W-4 from 2020 or later

An employee makes $750.00 per paycheck every week. According to their W-4, they’re

- single or married filing separately

- claiming $2,000.00 in qualifying credits

- would like an additional $56.00 to be withheld from each paycheck

Using Worksheet 2 and their W-4, we can calculate how much to withhold in federal income tax. In Step 1, we’ll calculate their adjusted wage amount.

- Since they did not enter anything in Steps 4(a) or 4(b) on their W-4, their adjusted wage amount is the full $750 they’ll make this pay period.

- If your team member did enter an amount on Step 4(a), divide that amount by the number of pay periods your company has each year. Then, add that amount to the employee’s total taxable wages for the pay period.

- If they entered an amount on Step 4(b), divide that amount by the number of pay periods your company has. Then, subtract that amount from the team member’s total taxable wages for the pay period and other income.

Find the wage bracket table for a weekly pay period. Locate the employee’s adjusted wage amount and their filing status.

You’ll enter that amount into Step 2 on Worksheet 2. This is the tentative amount you’ll withhold.

In Step 3, you’ll account for any tax credits your team member intends to claim. Enter the amount they entered on Step 3 of their W-4 and divide it by the number of pay periods your company has each year. Then, subtract that amount from the tentative withholding amount you found in Step 2 of Worksheet 2.

Finally, you’ll add any extra withholdings from Step 4(c) of the employee’s W-4 to the amount you found in Step 3c to determine how much to withhold from this paycheck. In this case, we’ll withhold $75.54.

Example using a W-4 from 2019 or earlier

An employee makes $750.00 per paycheck every week. According to their W-4, they’re

- filing single

- claiming one allowance

- would like an additional $20.00 to be withheld from each paycheck

Using Worksheet 3 and their W-4, we can calculate how much to withhold in federal income tax.

First, we’ll determine their tentative withholding amount. Find the wage bracket table for a weekly pay period and single persons. Locate the employee’s adjusted wage amount and the number of allowances they’re claiming.

You’ll enter that amount into Step 1b on Worksheet 3. Then, add any additional withholding to calculate how much to withhold. In this case, we’ll withhold $88.00.

Step 2: Calculate Social Security and Medicare taxes

Under the Federal Insurance Contributions Act (FICA), you’re required to withhold Social Security and Medicare taxes from your employees’ paychecks. You’re also required to match their contributions, so you’ll each pay 7.65 percent. To determine how much to withhold for FICA, use the following calculations:

- Determine how much to withhold in Social Security by multiplying your employee’s gross wages by 6.2 percent.

- Multiply your employee’s total wages by 1.45 percent to determine how much Medicare tax to withhold.

If your employee makes over $137,700, Social Security taxes will work a little differently. If they make over $200,000, you will need to withhold extra Medicare tax on some of their income.

Read also: A Beginner’s Guide to Social Security Taxes

Example

Using the same example as above, multiply the employee’s gross wages of $750.00 by 6.2 percent, which equals $46.50. That’s how much Social Security taxes to withhold. You’ll also pay that same amount as your employer’s portion.

Then, multiply $750 by 1.45 percent and withhold $10.88 in Medicare taxes. Don’t forget to pay that same amount as the employer.

Step 3: Determine state and local taxes

You’re also responsible for withholding and paying state and local payroll taxes. Every state, county, and city will have different rules about calculating payroll taxes, but you can contact your state’s tax agency to learn more.

Let payroll software do the work for you

Clearly, payroll taxes are complicated and can take a lot of your time to calculate when you run payroll. If you deduct anything from your employees’ paychecks, like health insurance premiums or retirement plan contributions, you also need to keep up with which deductions are taxable.

Thankfully, there’s an easier option: payroll software. Payroll software, like Workful, will calculate all your payroll taxes every time you run payroll. It will also keep track of your tax liability, so you’ll always know how much you need to deposit. When rates change, the software will update automatically. Instead of spending hours running payroll, you could be done in just minutes.

Read also: 4 Reasons to Switch to Payroll Software from a Manual Payroll System