Am I Exempt from Federal Withholding?

If you’re exempt from federal withholding, your employer will not withhold federal income tax from your paychecks. They’ll still withhold Social Security, Medicare, and state and local income taxes.

According to the IRS, you can claim the exemption if you meet the following criteria:

- had no tax liability last year and received a refund of all your federal income tax withholdings

- expect a refund of all your income tax withholdings because you will have no tax liability this year

If you’re not sure if you’re exempt, you can use the flowchart provided in Publication 505 to help you decide.

How do I claim my exemption?

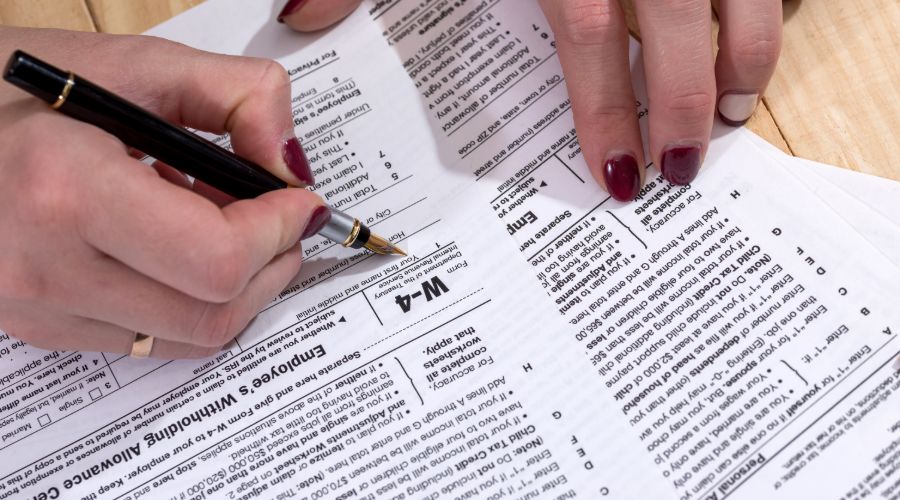

If you’ve determined that you’re exempt from federal income tax withholding, you can’t just tell your boss. Instead, you’ll need to fill out a new W-4 form and submit it to your employer. On your W-4, write “exempt” in the space below Step 4(c). Make sure you haven’t completed any other steps.

Your W-4 is used to determine how much income tax your employer should withhold, and the form usually doesn’t expire. But, if you’re claiming the exemption, you will need to submit a new form to your employer every year by February 15. If you submit the form after February 15, your employer won’t be able to accept the exemption and will have to start withholding federal income tax from your paychecks.

Read also: Tax Due Dates

What happens if my employer already withheld federal income tax?

Your employer has to withhold income tax from your checks until they receive your W-4 claiming an exemption. If you’ve been paid this year and had income tax withheld, you’ll receive a W-2 at the end of the year that includes how much was withheld. You can use that info to claim a refund when you file your annual tax return.