9 Financial Ratios to Know

Before you start analyzing your small business’s financial health, gather your balance sheet, income statement, and cash flow statement. Then, you can start using these common ratios to analyze your company’s profitability, liquidity, and debt liability.

Profitability ratios

Profitability ratios show you and potential investors how well your company can generate a profit.

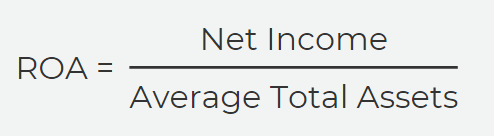

1. Return on assets

The return on assets ratio indicates how well your company uses its assets to make money. The higher your ROA, the better.

For example, if your company has a net income of $5,000 and owns $50,000 in assets, your ROA is 10 percent. So, for every $1 you own in assets, you make a $0.10 profit.

2. Return on equity

Your return on equity indicates your company’s ability to reward its investors. Like ROA, you want a higher ROE.

For example, if your company has a net income of $5,000, and your investors have $50,000 in equity, your ROE is 10 percent. In other words, for every $1 of capital, your company generates $0.10 in profits.

Read also: 9 Funding Sources for Your Small Business

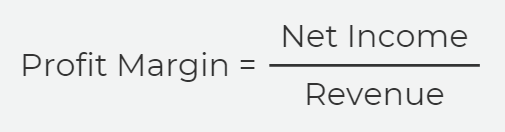

3. Profit margin

Your profit margin indicates how much of your sales revenue exceeds your costs. A high profit margin is good for your business.

For example, if you reported a net income of $5,000, and had total revenue of $20,000, your profit margin is 25 percent.

Read also: Back to Basics: Gross Profit

Liquidity ratios

Liquidity ratios show whether your company can use its assets to meet short-term debt obligations.

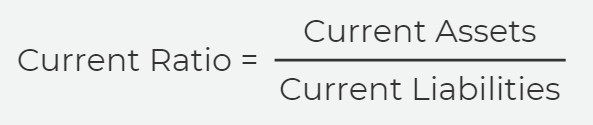

4. Current ratio

The current ratio indicates your business’s ability to pay your short-term debts, using short-term assets.

If your current ratio is over 1.0, you have more current assets than current liabilities and should not have any issues paying your short-term liabilities. If your current ratio is less than 1.0, you have more current liabilities than current assets and might run into problems paying your liabilities.

For example, if you have $30,000 in current assets and $25,000 in current liabilities, your current ratio would be 1.2.

Read also: What Should You Include on Your Chart of Accounts?

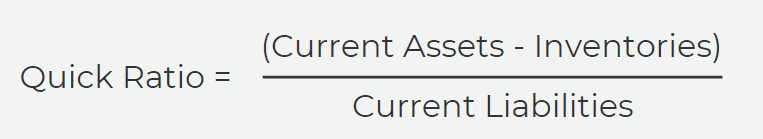

5. Quick ratio

Like your current ratio, your quick ratio measures how well your company can meet short-term obligations. Unlike your current ratio, your quick ratio doesn’t include inventory in your current assets. It assumes that it’ll take several weeks or months to sell your stock. The quick ratio only considers assets you can use today to pay your obligations.

Like your current ratio, if your quick ratio is less than 1.0, you may run into trouble if your liabilities become due.

For example, you have $30,000 in current assets, but $2,000 of that is in inventory. You also have $25,000 in current liabilities. Your quick ratio would be 1.12.

Debt ratios

Debt ratios indicate your company’s ability to meet long-term debt obligations.

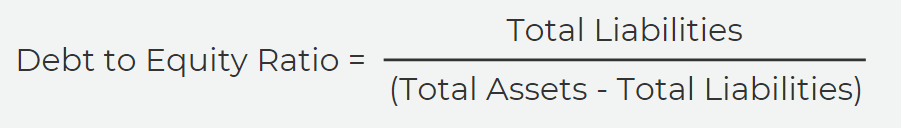

6. Debt-equity ratio

Your debt-equity ratio looks at the relationship between capital you’ve borrowed and capital you’ve raised through investors.

A high debt-equity ratio usually means your company has borrowed more aggressively, which means your company is a higher risk for new investors. A low debt-equity ratio signifies that your company is less of a risk. You’ll have to research typical debt-equity ratios in your industry to determine what’s a high or low ratio.

For example, if your company has $30,000 in liabilities and $50,000 in assets, your debt-equity ratio is 1.5.

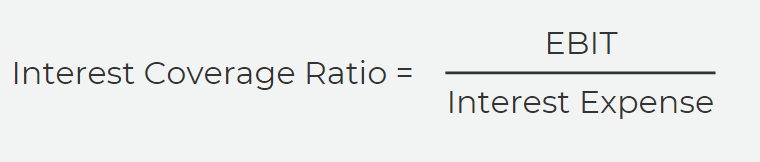

7. Interest coverage ratio

Your interest coverage ratio measures whether your company can meet its interest payment obligations. Before calculating your interest coverage ratio, determine your earnings before interest and tax by subtracting your expenses from your sales revenue.

If your interest coverage ratio is less than 1.0, your company might be in trouble. If you can’t meet your interest obligations, you might be forced to declare bankruptcy.

For example, if your sales revenue is $20,000 and your expenses are $5,000, your EBIT is $15,000. If your interest expense is $10,000, your interest coverage ratio is 1.5.

Efficiency ratios

Efficiency ratios show how well your business is using its resources and working capital.

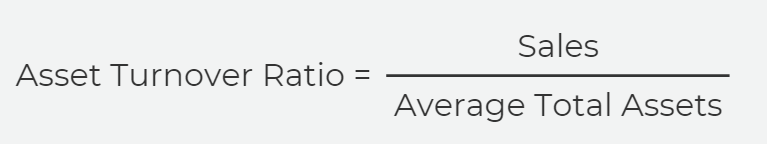

8. Asset turnover ratio

The asset turnover ratio measures how well you’re using your assets to make your products.

For example, if your sales are $30,000 and your assets are $15,000, your asset turnover ratio is 2. For every $1 you own in assets, you generate $2 in sales.

9. Inventory turnover ratio

The inventory turnover ratio measures how fast your company sells its inventory. You should try to sell your stock as quickly as possible.

For example, if your sales are $20,000 and your inventory is worth $5,000, your inventory turnover ratio is 4. The higher the ratio, the more quickly you’re selling and moving your stock.

Learn more about balance sheets, income statements, and cash flow statements.