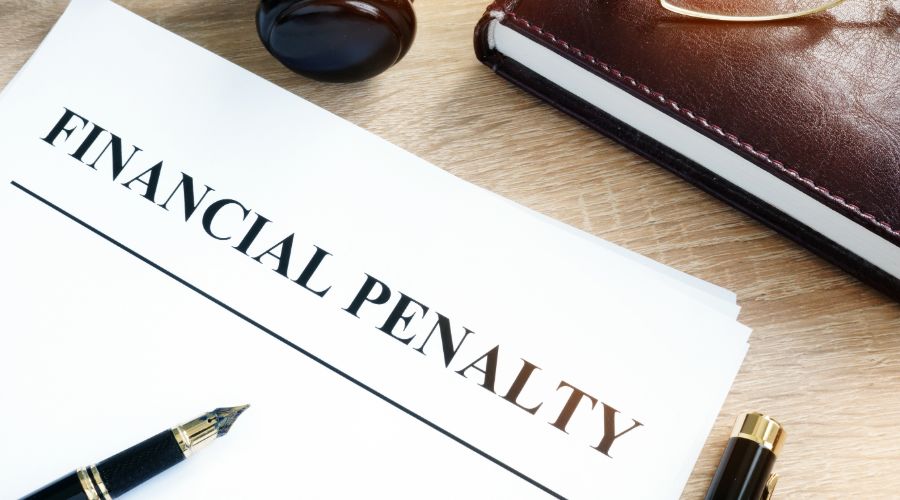

What are the Penalties for Filing a W-2 or 1099-MISC Late?

This article was last edited on 1/17/2020. For updated information on information return penalties, visit Increase in Information Return Penalties.

If you pay employees or independent contractors, you’ll need to file W-2 and 1099-MISC forms for each worker by January 31. If you don’t meet this deadline, you run the risk of facing some hefty penalties. The longer you wait, the higher the fine could be, so try to get your forms done sooner rather than later.

| When return is filed | Penalty per return | Max Penalty |

|---|---|---|

| Not more than 30 days late | $50 | $194,500 |

| Between 31 days late and August 1 | $110 | $556,500 |

| After August 1 or not at all | $270 | $1,113,000 |

| Intentional disregard | $550 | No maximum |

Why would you be fined?

You might face these penalties for not giving the form to its recipient if

- you don’t provide the correct statement by the due date without reasonable cause

- all the required information is not included on the form

- incorrect information is included on the statement

You could also face penalties for not filing with the IRS or Social Security Administration (SSA) if

- you don’t submit the form by the due date

- all the required information is not included on the statement

- incorrect information is included on the form

- you report an incorrect taxpayer identification number (TIN)

- you fail to report a TIN

- a corrected statement is not filed in a timely matter

- you file by paper when you’re required to file electronically

- you didn’t submit a machine-readable form

If you knew you were supposed to file forms and did not, then you run the risk of being fined for intentional disregard.

Are there exceptions for filing late?

Penalties are up to the IRS’s discretion, so there are some cases where you might be able to avoid a fine.

- Reasonable cause – You need to show that the failure to file was due to events beyond your control or significant mitigating factors. You’ll need to prove that you acted responsibly and took the necessary precautions to avoid the mistake.

- Inconsequential errors – Inconsequential errors are mistakes or omissions that do not hinder the IRS or SSA from processing the form, connecting the information on the form to the recipient’s tax return, or using the form as intended. An error will never be inconsequential if it’s related to a TIN, recipient’s surname, dollar amount, or significant part of the recipient’s address.

- De minimis rule – If you initially filed the form on time but need to make corrections, you may be able to avoid the penalty if you file corrections by August 1.

- Safe harbor rule – You might be able to avoid penalties for incorrect dollar amounts if

- no amount differs from the correct amount by more than $100

- no tax withheld amount differs from the correct by more than $25

Tax mistakes can cost your small business a lot of money. Learn how to avoid seven common tax mistakes.