Back to Basics: Working Capital

Working capital is the cash your company has available for its day-to-day operations. Having enough money to function is particularly important during the startup phase of your business. It’s a good idea to keep an eye on it to know if you can continue operating well. If you notice it’s decreasing, you might need to look for ways to lower your liabilities by negotiating terms. You might also try increasing your assets by raising more funds or taking out a loan.

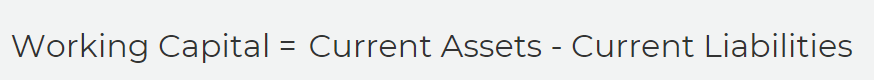

Calculating your working capital

To calculate your working capital, subtract your current liabilities (debts due within one year) from your current assets (things you own that can be converted into cash quickly). If your assets don’t exceed your current liabilities, you may run into trouble paying back your creditors.

For example, if your current assets are $7,500 and your current liabilities are $5,000, your working capital is $2,500.

Read also: What Should You Include on Your Chart of Accounts?

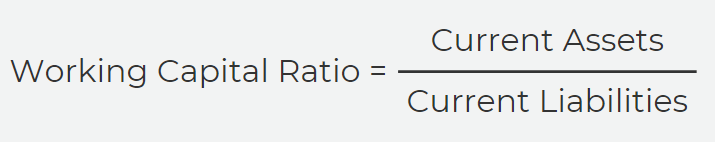

Working capital ratio

You can also calculate your working capital ratio, which measures whether your company has enough short-term assets to cover your short-term debts.

For example, if your current assets are $7,500, and your current liabilities are $5,000, then your working capital ratio is 1.5.

A ratio below 1.0 indicates a negative working capital. If you notice that it’s decreasing over time, it could be a red flag, and you should investigate to determine the cause.

A higher ratio may not necessarily be a good thing. If it’s greater than 2.0, it may indicate that you’re not investing your excess assets into growing your company. It may also suggest that you have too much inventory or accounts receivable, neither of which can be used to pay back your short-term debts immediately.

Read also: 5 Tips for Managing Your Inventory