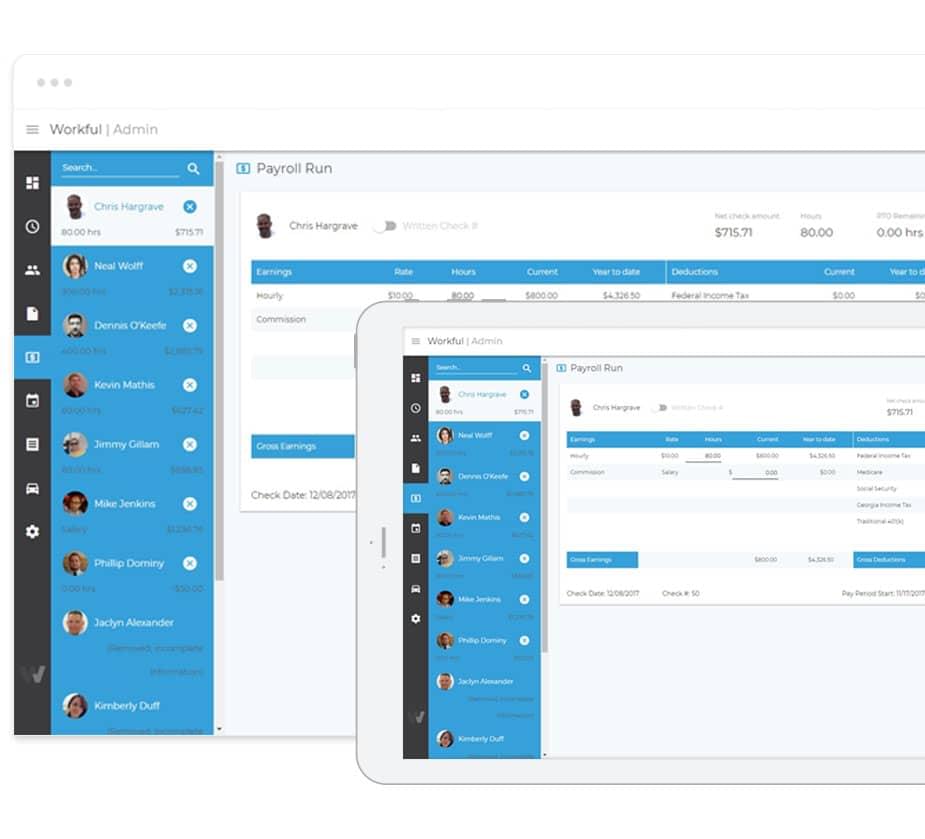

Run Payroll

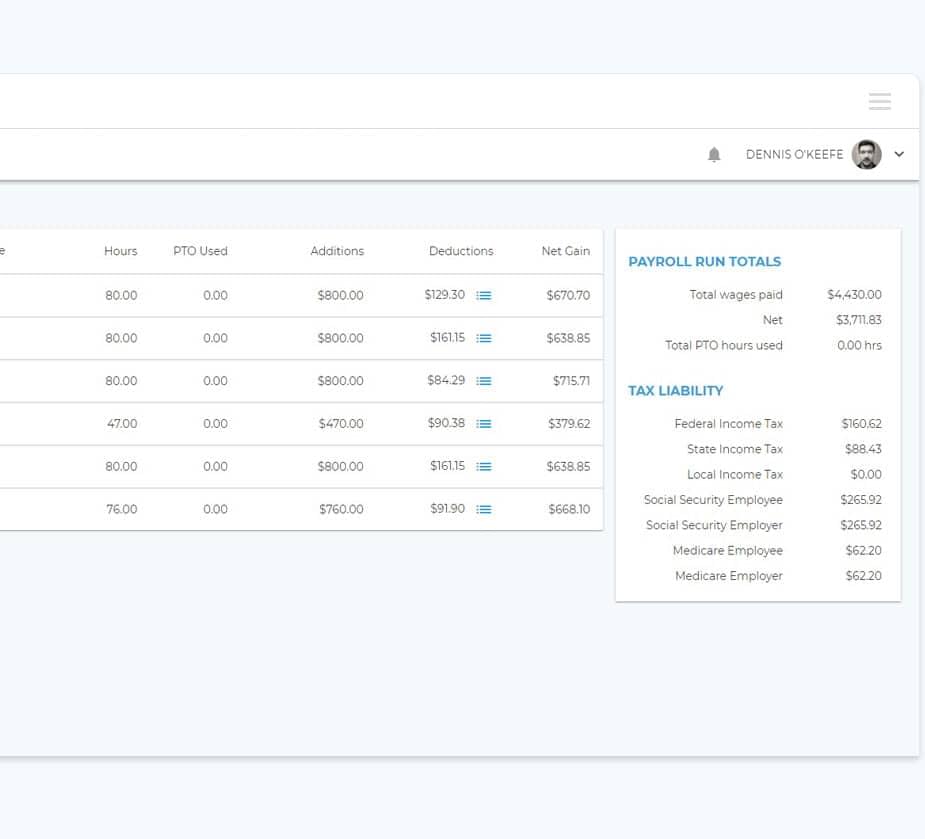

Payroll syncs automatically with your employees’ time clocks, time off requests, and reimbursement requests, so you can run payroll in less than 5 minutes.

How do you run payroll with Workful? It's easy!

- Add an employee.

- Approve time off requests, time clock adjustments, and expense and mileage requests in seconds.

- Run payroll in just 4 clicks.

- Celebrate!

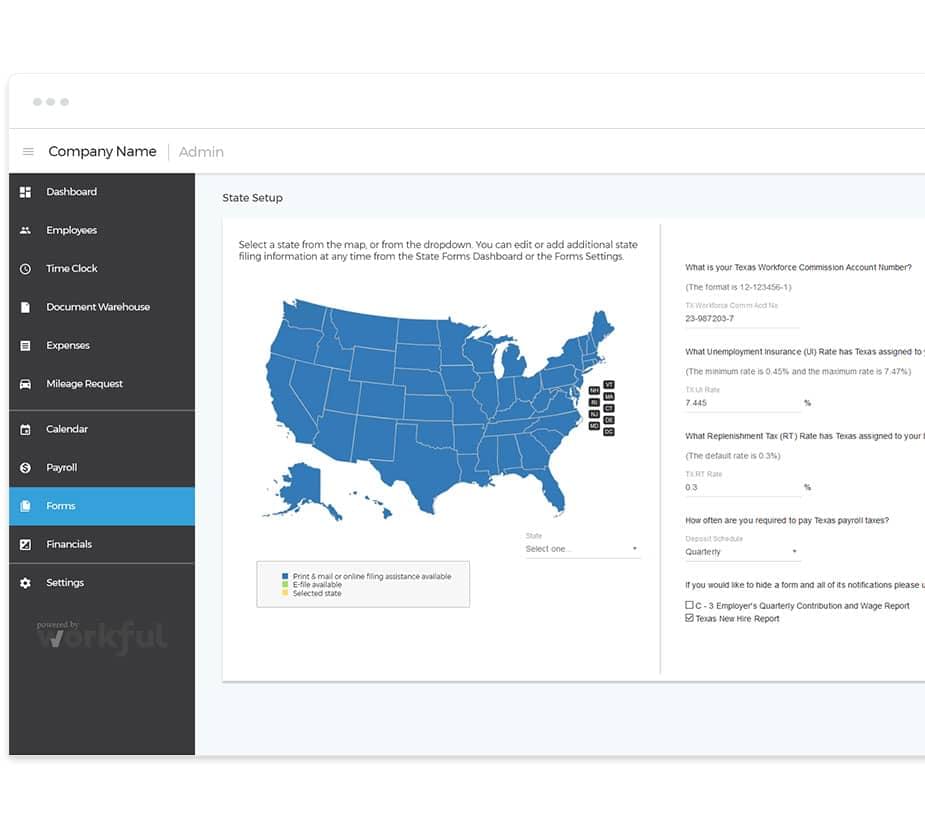

Workful Payroll is completely online, so you can run payroll anytime, anywhere.